USA Property Tax Calculator: Buying a home is the American Dream, but the annual property tax bill can sometimes feel like a nightmare. For many homeowners, property taxes are the second largest housing expense after the mortgage itself.

Whether you are a first-time homebuyer trying to budget your monthly payments, or a real estate investor analyzing ROI in different states, knowing your tax liability is crucial.

However, calculating property tax in the USA is notoriously confusing. Rates vary not just by state, but by county, city, and even school district.

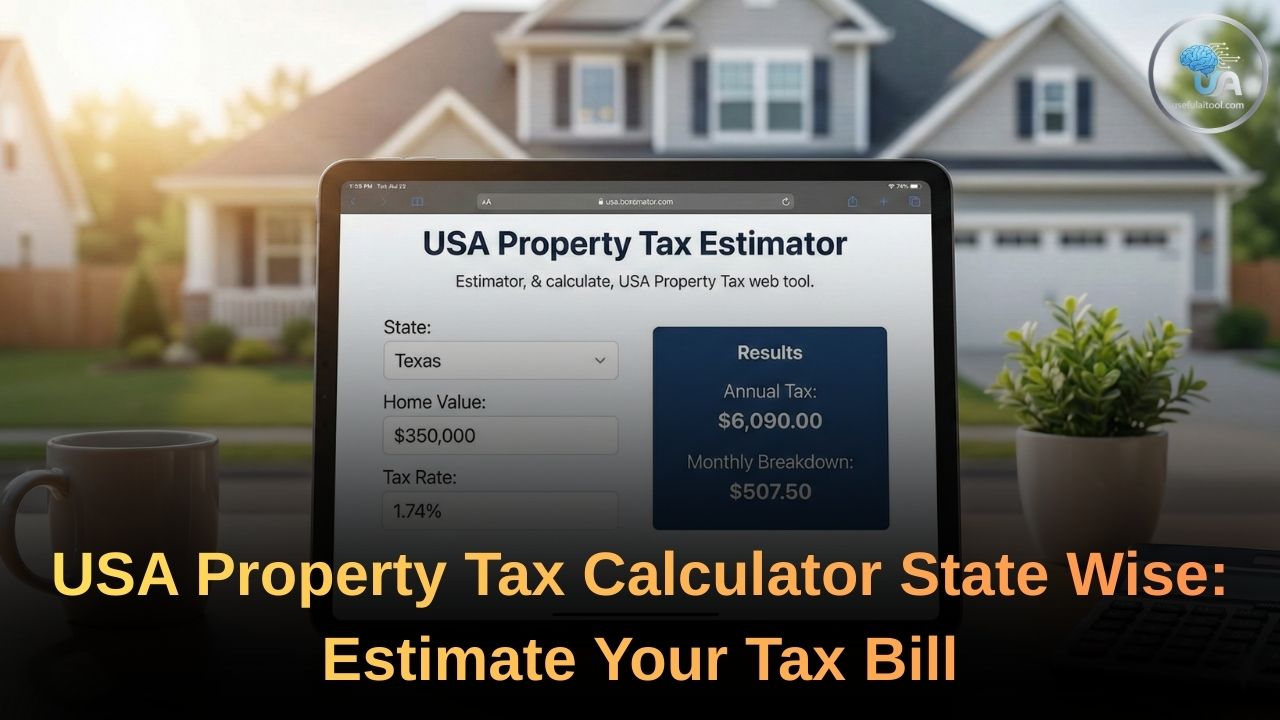

That is why we built the Free USA Property Tax Calculator. This tool comes pre-loaded with the latest average effective tax rates for all 50 states, allowing you to instantly estimate your annual and monthly obligations.

How to Use This Property Tax Calculator

We have designed this tool to be the simplest and most accurate estimator on the web. Here is how to get your numbers:

USA Property Tax Calculator

Estimate your annual property tax based on state averages

$0.00

Monthly: $0.00

*Disclaimer: These are based on state averages. Actual taxes may vary by county and local jurisdiction.

- Select Your State: Choose your location from the dropdown menu. The tool will automatically load the Average Effective Tax Rate for that state (based on 2025 data).

- Enter Home Value: Input the Assessed Value of the property. (If you don’t know the assessed value, you can use the listing price or market value for a rough estimate, though assessed value is usually lower).

- Adjust the Rate (Optional): If you know the specific tax rate for your county, you can manually edit the percentage field for pinpoint accuracy.

- See Your Result: The calculator instantly breaks down your cost into Annual Tax and Monthly Tax.

Pro Tip: Most lenders require you to pay property taxes monthly into an escrow account. Use the “Monthly Tax” figure to see how much will be added to your mortgage payment.

How is Property Tax Actually Calculated?

To understand your bill, you need to understand the math behind it. Property taxes are “ad valorem” taxes, meaning they are based on the value of the transaction or property.

The basic formula is:

Property Tax=Assessed Value×Tax Rate

1. Assessed Value vs. Market Value

This is the most common point of confusion.

- Market Value: The price a buyer is willing to pay for your home today (e.g., $450,000).

- Assessed Value: The value the local tax assessor assigns to your home for tax purposes. In many municipalities, the assessed value is only a percentage (e.g., 80% or 90%) of the market value.

Note: Our calculator assumes the value you enter is the Assessed Value.

2. Understanding “Mill Rate”

While our calculator uses percentages (like 1.5%), you might see the term “Mill Rate” on your official tax bill.

- 1 Mill = $1 of tax for every $1,000 of assessed value.

- So, a Mill Rate of 20 means you pay $20 for every $1,000 your home is worth.

Property Tax Rates by State (2025 Overview)

Where you live largely determines how much you pay. The USA has a massive disparity in tax rates. Some states fund their services through high income tax and keep property tax low, while others do the opposite.

Also Read: Delhi Circle Rate 2026 Calculator with PDF: Calculate Your Property Value and Registration Charges

The Most Expensive States for Property Tax

If you live in the Northeast or parts of the Midwest, prepare for higher bills. These states often rely heavily on property taxes to fund excellent public school systems.

- New Jersey (2.47%): The highest in the nation. A $400,000 home here creates a ~$9,880 annual bill.

- Illinois (2.23%): High taxes primarily due to local pension debt and school funding.

- Connecticut (2.15%): High property values combined with high rates.

- New Hampshire (2.09%): NH has no state income tax, so they make up for it with high property taxes.

- Texas (1.74%): Like NH, Texas has no state income tax, so property taxes are the main revenue source for local governments.

The Cheapest States for Property Tax

If you want to minimize housing costs, these states are tax havens for property owners:

- Hawaii (0.28%): While home prices are incredibly high, the tax rate is the lowest in the US.

- Alabama (0.41%): Low property values and low rates make it very affordable.

- Colorado (0.51%): Residential property is assessed at a much lower percentage of market value.

- Louisiana (0.55%): Offers generous homestead exemptions.

- South Carolina (0.56%): A popular destination for retirees due to low tax burdens.

4 Ways to Lower Your Property Tax Bill

Just because the tax assessor sends you a bill doesn’t mean you have to pay that exact amount. There are several legal ways to reduce your liability.

1. Apply for the Homestead Exemption

This is the single easiest way to save money. If the property is your primary residence (you live there, you don’t rent it out), most states allow you to deduct a portion of the home’s value from taxation.

- Example: If your home is worth $300,000 and your state offers a $50,000 homestead exemption, you only pay taxes on $250,000.

2. Check for Specialized Exemptions

States offer breaks for specific groups. Check if you qualify for:

- Senior Citizens: Many states freeze property values for those over 65.

- Veterans: Disabled veterans often receive significant tax reductions or full waivers.

- Disability: Persons with disabilities may qualify for reduced rates.

3. Appeal Your Assessment

If you believe your home’s Assessed Value is too high compared to your neighbors, you can appeal.

- Check your “property record card” at the town hall for errors (e.g., they list 4 bathrooms, but you only have 3).

- Pull “comps” (comparable sales) of similar nearby homes that sold for less than your assessed value.

- Present this evidence to the local Board of Appeal.

4. Avoid “Curb Appeal” Before Assessment

If an assessor is coming to value your home, hold off on major cosmetic upgrades (like a new deck or shed) until after the assessment is complete, as these improvements instantly increase your taxable value.

FAQ on USA Property Tax Calculator

Does property tax include mortgage insurance?

No. Property tax is a tax paid to the government. Mortgage insurance (PMI) is a fee paid to your lender. However, both are often bundled into your single monthly mortgage payment.

When are property taxes due?

This depends on your location. Most counties collect taxes twice a year (semi-annually) or quarterly. If you have an escrow account with your mortgage lender, they pay this bill on your behalf automatically.

Is property tax tax-deductible?

Yes, generally. The SALT (State and Local Tax) deduction allows you to deduct up to $10,000 combined for state income taxes and property taxes on your federal tax return.

Start Calculating Now

Don’t get blindsided by your next tax bill. Scroll up to use our USA Property Tax Calculator and plan your finances with confidence today.

![Flight Speed Test Online [2026] How Fast are You Flying Right Now](https://usefulaitool.com/wp-content/uploads/2026/02/Flight-Speed-Test-Online-2026-How-Fast-are-You-Flying-Right-Now.jpg)