Tax Saving Investment Calculator US: Tax Saving Investment Calculator US: Nobody likes seeing a massive chunk of their paycheck disappear to taxes. Whether you are a salaried employee, a freelancer, or a small business owner, tax season often brings a mix of confusion and dread.

But here is the truth that wealthy individuals have known for decades: You don’t have to pay taxes on all of your income. The US tax code is packed with legal loopholes and incentives designed to help you build wealth. By putting your money into specific “tax-advantaged” accounts, you can drastically reduce your taxable income—meaning you keep more of your hard-earned money and give less to the IRS.+1

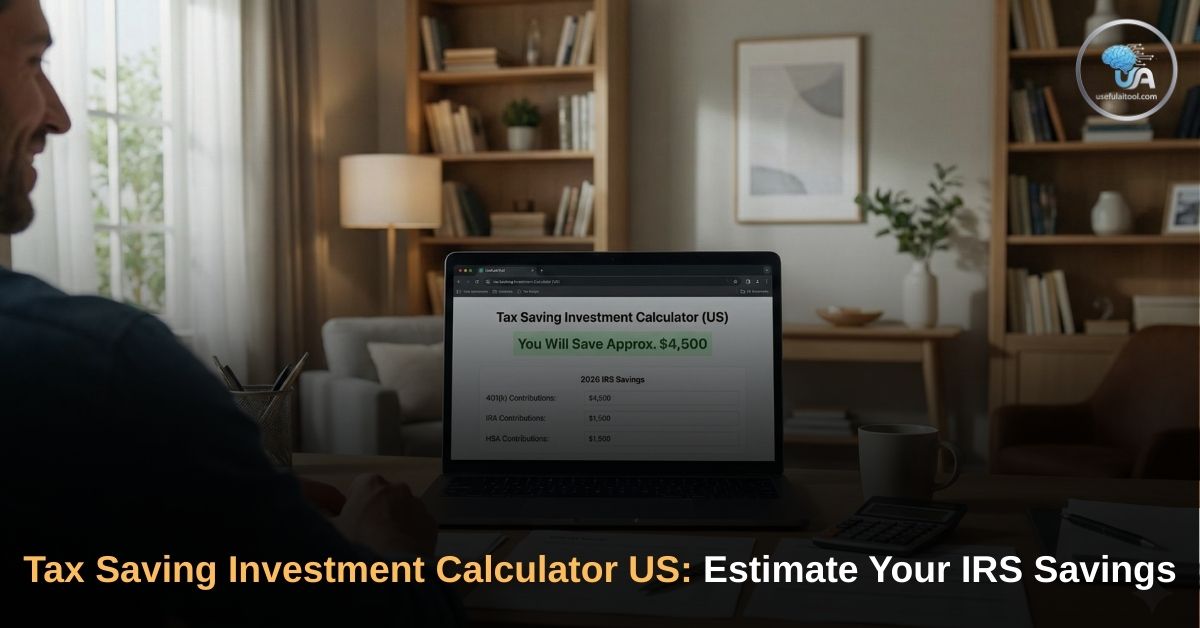

That is exactly why we built the UsefulAITool Tax Saving Investment Calculator (US).

This free, easy-to-use tool takes the guesswork out of tax planning. By entering a few basic numbers, you can instantly see how your investments lower your tax bracket and put cash right back into your pocket.

What is a Tax Saving Investment Calculator?

Our Tax Saving Investment Calculator US tool is a digital financial planner. It uses the latest IRS federal tax brackets and standard deduction rates to simulate your tax return before you even file it.

Most people wait until April to think about taxes, but by then, it is too late to make changes. This tool helps you plan proactively. It calculates your “Above-the-Line Deductions.” These are contributions you make to specific retirement and health accounts that are subtracted from your gross income before the IRS calculates your tax bill.

🇺🇸 Tax Saving Investment Calculator

*Estimates based on official 2026 IRS Federal Tax Brackets. Does not include State Tax or FICA.

If you make $90,000 a year but put $10,000 into a qualifying account, the IRS taxes you as if you only made $80,000. It is that simple.

The "Big 3" Tax-Deductible Investments for Americans

To get the most out of our calculator, you need to understand the three main buckets where you can hide your money from the taxman legally.

1. The Traditional 401(k) / 403(b)

This is the workhorse of American retirement planning. Offered by most employers, the money you put into a Traditional 401(k) comes straight out of your paycheck before taxes are applied.

- The Benefit: Immediate reduction in taxable income. Plus, many employers offer a "match," which is essentially free money.

- The Limit: For the 2025/2026 tax years, limits are generous (often exceeding $23,000 per year, with "catch-up" contributions for those over 50).

2. The Traditional IRA (Individual Retirement Account)

Don't have a 401(k) at work? A Traditional IRA is your best friend. You can open one yourself at any brokerage (like Vanguard or Fidelity).

- The Benefit: Depending on your income level and whether you have a retirement plan at work, contributions to a Traditional IRA are fully tax-deductible.

- The Limit: Generally around $7,000 per year.

3. The HSA (Health Savings Account) - The Triple Tax Threat

If you have a High Deductible Health Plan (HDHP), you are eligible for an HSA. Financial advisors consider this the ultimate tax hack.

- The Benefit: It is triple-tax-advantaged. The money goes in tax-free (deduction), grows tax-free (investment), and comes out tax-free (if used for medical expenses).

- The Limit: Around $4,300 for individuals and $8,550 for families.

How to Use the Tax Saving Calculator

Using the tool is incredibly straightforward. You don't need a degree in finance or a CPA to figure it out.

Step 1: Select Your Filing Status Are you filing as Single, Married Filing Jointly, or Head of Household? The IRS uses different brackets and standard deductions for each, so this is crucial for an accurate calculation.

Step 2: Enter Your Gross Income This is your total salary before any taxes or deductions are taken out.

Step 3: Input Your Investments Play around with the numbers! Enter how much you plan to contribute to your 401(k), IRA, and HSA this year.

Step 4: Calculate Your Savings Hit the calculate button. The tool will instantly show you:

- What your tax bill would be without investing.

- What your new tax bill is with investing.

- Your Total Tax Savings (The exact amount of money you saved from going to the IRS).

Why Marginal Tax Brackets Matter

One of the smartest features of our tax saving investment calculator us tool is that it calculates your savings based on your Top Marginal Tax Bracket.

🚀 Explore More Free Tools

Level up your workflow with our top-rated utilities.

🎮 Gaming & PC Builds

- FPS Calculator (PC Test) Simulate your hardware and check for CPU/GPU bottlenecks.

- Monitor Hz Tester Verify your 144Hz screen with our real-time motion test.

- Mouse Click Speed Test Test your reflexes and calculate your Clicks Per Second.

🎥 For Content Creators

- Script Reader AI Listen to your screenplay out loud and estimate video runtime.

- YouTube Tag Extractor Find viral keywords used by top YouTubers to boost your SEO.

- Thumbnail Downloader Download high-res YouTube thumbnails instantly.

📈 Finance & Planning

- US Tax Saving Calculator Estimate your 2026 IRS tax savings via 401(k) and HSA.

- Pension Calculator Secure your future and calculate expected monthly returns.

📱 Tech & Lifestyle

- Used Phone Calculator Get an instant resale value estimate before you sell your old device.

- Astrology Sign Calculator Discover your "Big 3" personality traits instantly.

The US uses a progressive tax system. You aren't taxed one flat rate on all your money. Instead, your income fills up different "buckets." The last dollar you earn is taxed at the highest rate (your marginal rate).

When you contribute to a 401(k) or HSA, you are removing money from that very top bucket. For example, if you are in the 24% tax bracket, every $1,000 you invest in a traditional 401(k) saves you exactly $240 in federal taxes. The calculator does this math for you instantly.

FAQs on Tax Saving Investment Calculator US

Q1: Does this tool calculate State Taxes or FICA?

No. To keep the tool universally accessible and lightning-fast, it focuses strictly on Federal Income Tax, which is the largest tax burden for most Americans. It does not calculate State Income Tax or FICA (Social Security and Medicare), so your actual savings might be even higher than what the tool shows!

Q2: What is the difference between a Traditional and Roth account?

Our calculator measures deductions for Traditional accounts. Traditional accounts give you a tax break today (which lowers your current tax bill). Roth accounts give you a tax break in the future (you pay taxes now, but the money grows and is withdrawn tax-free in retirement).

Q3: Do I need to itemize my deductions to get these benefits?

No! That is the beauty of 401(k), Traditional IRA, and HSA contributions. They are "Above-the-Line" deductions. You can take the massive Standard Deduction and still get the tax benefits from these investments.

Conclusion: Keep Your Money Working For You

Every dollar you hand over to the IRS is a dollar that isn't compounding in the stock market or securing your future. By strategically utilizing 401(k)s, IRAs, and HSAs, you can drastically lower your tax burden while building a massive nest egg.

Don't wait until tax season to figure out your strategy. Use the UsefulAITool Tax Saving Investment Calculator (US) today, run your numbers, and take control of your financial future.

💰 Ready to see how much you can save? Scroll up, enter your numbers, and maximize your wealth today!

![Mouse Click Speed Test Online [Free]: Check Your CPS (1s, 5s, 10s) & Rank Up](https://usefulaitool.com/wp-content/uploads/2026/02/Mouse-Click-Speed-Test-Check-Your-CPS-1s-5s-10s-Rank-Up.jpg)